Understanding market trends: How to bind (USDT) influences trading strategies

The cryptocurrency world has also increased rapidly in recent years, making it difficult for merchants to browse the market. One of the main factors affecting trading strategies is the use of as stable as Tether (USDT). In this article, we will go into how the influence of USDT on market trends is influenced by trade strategies and will provide insights to traders who want to successfully implement the cryptocurrency market.

** What is the attachment (USDT)?

The Tether (USDT) is a Fiat currency -backed cryptocurrency that was associated with ITLT 1: 1 in US dollar. It is in 2014. Started the Union National Swiss Bank, but only in 2017. He gained great adhesion and popularity. Today, USDT is one of the most widely sold cryptocurrency in the world.

How to attach influence on market trends?

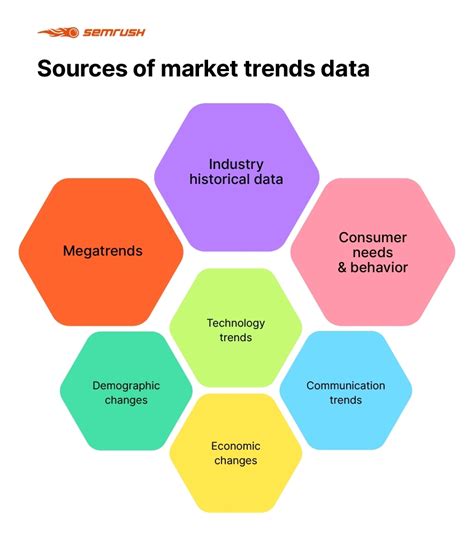

The influence of USDT on market trends can be attributed to several factors:

- And vice versa, when supply exceeds demand, the price decreases.

2.

- Market mood

: perception of risk and variability associated with USDT can affect the mood of the market and influence prices in certain markets.

** How to tie (USDT) affects trading strategies?

Traders use a variety of methods to use price changes that are influenced by attachment:

1

2.

- Speculation in the future markets : Tether Stablecoin makes it easy to speculate on future price changes without worrying about actual currency value fluctuations.

4.

TETHER effect on specific market trends

USDT is particularly useful for merchants who want to trade:

1

2.

Conclusion

The influence of Tether on market trends has become increasingly important for merchants who want to succeed in cryptocurrency space. Understanding how USDT is working on trading strategies and adapting to their factors, traders can make more reasonable decisions and increase their success in this rapidly developing market.

However, it is very important to remember that cryptocurrencies always have a characteristic risk and there is no guarantee, return or profit. Traders should:

- Perform detailed research on binding and other cryptocurrencies.

- A set of real expectations based on market conditions.

- Be informed about market news and trends

.

By combining knowledge with caution and well -eliminating trade strategy, traders can browse the ever -changing landscape of cryptocurrency markets and make reasonable decisions to achieve their financial goals.