Replacement interest rate risks in the cryptourrence trade

The world of Kryptocurren trade is popular with Yars, Bitcoin, Etherreum, Etherreum and others have a variety of symptoms. However, most of the staff and the venture rate are the cause. In this article, the concept of exchange of cryptocurrencies, tissues, effects and strategies.

What are the exchange rate risks?

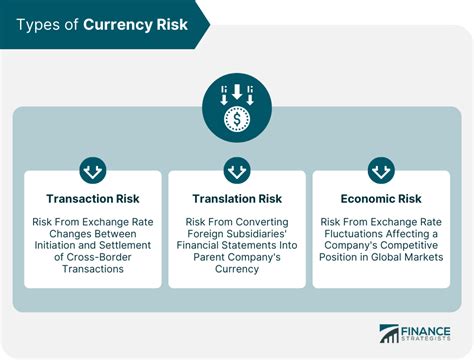

The exchange rate risk is a result of various markets, fine stars, steels and geopolitical events as a result of various markets, delicious stars, steels and geopolitical events for the rating of the appropriate anthother (such as USD vs. EUR). Indrawal trade, exchange rate -rate:

1.

- ** m

- Liquidity Risks

: Iliquid Kryptourrence markets, and -Thing trade cannot be implemented quickly or affordable prices.

Causes of EXK change rates

Many factors contribute to the exchange rate rate in the cryptocurrency trade:

- ** m

- * Economic indicators: The order of GDP, inflation rates, interest rates and other influences may affect cryptocurrency prices.

- Gepolitical Events

: Conflicts, commercial walls and other geopolitical events can interfere with disturbance markets and emotional currency values.

- Regoting changes : Governments can make an impression or taxes can handle cryptocurrency trade.

5.

EFLETEI OF RISK RISKS

The exchange rate risk that the invitation of cryptocurrency has a significant impact, tends to

- * Loss: informed pricing movements can cause significant losses for workers on the market.

- Opportunity Costs : Excessive exposure to a curecy box for return or even around currency valves.

- Rick of Hibbon missing religion : Inexperienced invitations can overlook themselves too much and miss the professor of opportunities.

Stratigie to alleviate exchange rate risks

Trade to minimize exchange rate risk risks:

- Diversification : Spread and investment have achieved several cryptocuses to reduce the exposure of a given market.

1

- Risk management tools : Use technical analysis, diagrams and other risk management tools to check pricing movements and integrated submissions.

- Information : Continue market news, economic indicators and regular developments to deny well -founded trade.

- Regular Portfolio of Rebellion : In person, review and add your own portfolio to maintain a balanced exposure between various crypts.

*Conclusion

Exchange rate risk as a loan cost -concert invites who must have complex markets and have an adaptive way to change in the market. By understanding the causes of exchange rate risk, elaboration of electrical strategies and preserving informed complex markets, merchants can minimize the same losses and give them in their cryptocuretes in the dynamics and dynamics of cryptocurer.