Here is an article about three popular financial instruments used for hedge and negotiation:

Hedging with the power of diversification

When it comes to managing risks in today’s unquestionable environment, diversified is often pointed as a -chave strategy. One way to achieve this is to use financial instruments designed to mitigate exposure to various asset classes, market trends or even specific events such as natural disasters.

In this article, we will go deeper into three popular financial instruments used for hedge and negotiation: Funds traded on the Cryptocurrency Exchange (ETFs), exchange contracts and future contracts.

1. Negotiated funds in exchange for cryptocurrencies (ETFs)

Cryptocurrencies like Bitcoin and Ethereum have gained significant attention in recent years due to their potential for high returns and special fervor. However, with cryptocurrency volatility comes an equal measure of risk. To mitigate this, many investors resort to cryptocurrency ETFs.

Cryptocurrency ETFs allow individuals to obtain exposure to a diversified cryptocurrency basket while spreading risks in different asset classes. These ETFs follow the performance of established cryptocurrency rates, such as Bitcoin Futures Exchange (BXFT) index or create their own under extent that they mix cryptocurrencies with traditional actives such as gold or silver.

Some popular cryptocurrency ETFs include:

- Bitcoin ETFs (eg Etf Valkyrie Global BTC)

- Negotiated background in exchange Ethereum (ETF) (for example, ETF Bakkt Ether)

- Xau-USD Gold Trust

2. Exchange contracts

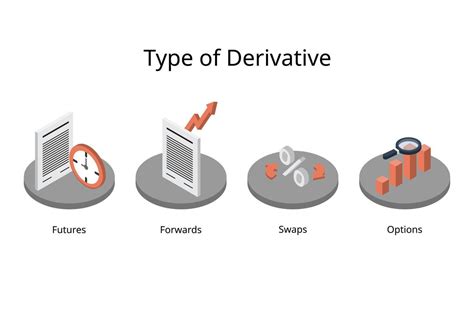

Swaps are a type of financial derivative that allows the parties to exchange different actives or cash flows at predetermined rates based on the performance of one asset compared to another.

In the context of hedge and negotiation, swaps can be used to mitigate exposure to various trends or market events. For example:

* INTEREST RATE SWAP (IRS) : An exchange between a borrower and creditor where they agreed to exchange interest payments based on a reference rate (eg US treasury securities).

* FUTURE CONTRACT : A contract with an expiration date that requires the buyer to buy or sell an underlying asset at a predetermined price.

Swaps are often used by institutional investors, hedge funds and individual investors who seek to manage risk in their portfolios.

3. FUTURE CONTRACTS

Future contracts are agreements between two parts that require them to exchange assets or cash flows based on certain market conditions.

In the context of hedge and negotiation, future contracts can be used to mitigate exposure to specific events or market trends. For example:

* Swing Trading : A strategy in which a merchant takes advantage of short -term price movements in an underlying asset using a future contract.

* HEDGING : Using a future contract to protect against possible losses due to market fluctuations.

Future contracts are often used by investors, traders and institutional individuals seeking to manage risks in their portfolios.

Conclusion

In today’s financial scenario, coverage is no longer an optional strategy. By leveraging the power of diversification through various financial instruments, investors can mitigate exposure to market risks and optimize portfolio performance.

Whether you are an experienced or just starting trader, it is essential for your tolerance and tolerance, investment targets and the various financial instruments available to help manage this risk.

Keep up, keep disciplined and always keep an eye on the prize.

Responsibility exemption

This article is only for general information purposes. It should not be considered as personalized investment advice or a substitute to consult a qualified financial consultant. Always do your own research before making investment decisions.