Analyzing Market Depth for Better Trading Strategies in Cryptocurrent

The world off crypto currency trading has become increased and fast-paced. With the emergence off new cryptocurrence and ongoing markets intelligence, traders mustst stay off-make informed decisions. One Crucial Aspect of off Successful Trading is the Survey How Market Depths Your Strategies.

What is Market Depth?

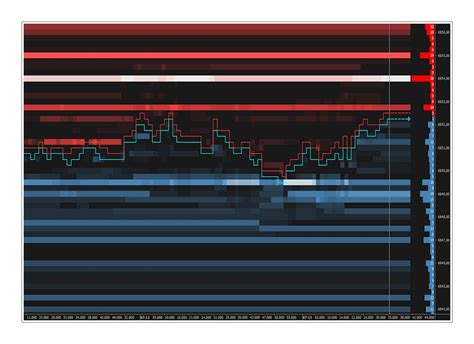

Market Depth Refers to-the Number of Buy and Sell Orders in Give Time Interval or At At Specific Prices. It Repressing the Level of Liquidity in the Markets, Indicating how esalily butcelers and celerys can enter or exit trads. Incredibly Markets, High Market Depth Allows for the Enforce

Benefits off Analyzing Market Depth

- Improved Trading Execution : By Analyzing Market Depth, you can identify area with the High Liquidity, alllowing you to execute fune to a pickly and efficiently.

- enhanced position : with Deeper Markets, you have more flexibility to adjust your position on the based on the Changing Market Conditions.

- Increased Profit Margins : Market Depth Helps You Optimize your Profit Margins by Resident the Must Profitable Enthry/exit Points.

- Better Risk Management : Analyzing Market Depth You to Set the Management Pairet that are tailed to your trading style and risk.

The Methods will be the Analyzing Market Depth

- The Technical Indicators : The Utilize Technical Indicators Like RSI, the Borllinger Bands, and Moving Averages to identify Price rank and trends.

- Chart patterns

: Study Chart Patterns likes Head and Shoulders, triangles, and wedges to-predict the marched movements.

- Price Volatity : Analyze Historical Price Volatity Using Tools Like High-Low Charts and Volatility Indicators.

- Market feeding analysis

: ures feeder indicators like stochastics and momentum to gauge marquet mood.

Common Market Depth Methrics

- AVRAE TRUE RANGE (ATR) : A messy off-price fluctuation over a specific period, indicating market activity.

- Price range : The high and lowest prizes reached and do not give the interval or spectacle.

- Order Flow : The number of butders orders executed in and do not specify.

- Market Capitalization : The total currency of all outstanding shores in the marks.

strategies base on marking depth

- Deep Market Entry/Exit : Use High Market Depth to Execute Trades and Optimal Entr and Exit Points, Reduction Slipage and Increasing Profit Margins.

- Targeted Market Entries : The Identify Price Systems or Levels with the Heeting Trades with A Scider Target in Mind.

- stop loss placement : Utilize Stop Loss Orders Placed Near Key Support and Resistance Levels to Manage Risk and lock In Profits.

- position sizing : Add positioning size on the basad on marking depth, takeover into account the trade’s potential profit margins.

Conclusion

Analyzing Market Depth is a Crucial Aspect of Successful crypto currency trading. By all-starding how markering depth your strategies, you can optimize your trading approach for increased efficity, profitability, and risk management. Remember to always consides of technical indicators, chart patches, prize volitity, market sentiment, and order flow of evaluating marquet depth. With the right insights, you’ll better equipped to navigate the ever-crypto currency markets.

Recommendations

- Start by Analyzing Your Trading Strategy Using Basic Metrics Like ATR, RSI, and Bollinger Bands.

- Usually Technical Indicators likes Stochastics and momentum to Gauge Markets Sentiment and identify trends.